A government’s ‘budget balance’ is simply the difference between what the government spends into the economy and what it removes through taxes and other charges over a given period, usually a financial year. A ‘deficit’ means that government spending exceeded than taxation. A surplus is where taxes exceed spending.

These are very unfortunate words to use. After all, most people would think that deficits are a bad thing and surpluses are good. But from the point of view of the Australian economy, the opposite is usually true.

Think, for a second, about a Commonwealth surplus. When the Commonwealth runs a surplus it means that the Commonwealth took more dollars out of the economy than it put back in. This must mean that there are fewer dollars in the economy.

Now think about what dollars are used for. People like you and I use them to buy things. And when we buy things, we engage in ‘economic activity.’ So, the fewer dollars we have to spend, the less economic activity we can engage in.

Put simply, because surpluses take money out of the economy, they make the economy smaller.

When the Commonwealth runs a surplus, the only way that the economy can have more dollars for growth is if the private sector borrows more. This is because the only way that the private sector can create dollars is through debt. What’s more, those ‘private sector dollars’ only exist until the debt is repaid. So, for example, if the household sector tried to reduce it’s debt levels, this would also restrict economic growth.

When the Commonwealth runs a ‘deficit,’ it leaves more money in the economy. The private sector can then use those dollars to drive economic growth. And it does so without taking on the risk of more private debt.

Most of the time, this is a good thing. More economic activity is usually better than less economic activity. Very occasionally, we may want to reduce economic activity. For example, at times when inflation is being driven by excess spending, we may want to encourage people to spend less.

One way to do that is to run a deficit, because deficits mean less money is available to spend. If we complement that with higher interest rates, this will make it harder for the private sector to borrow money into existence, and so spending will fall.

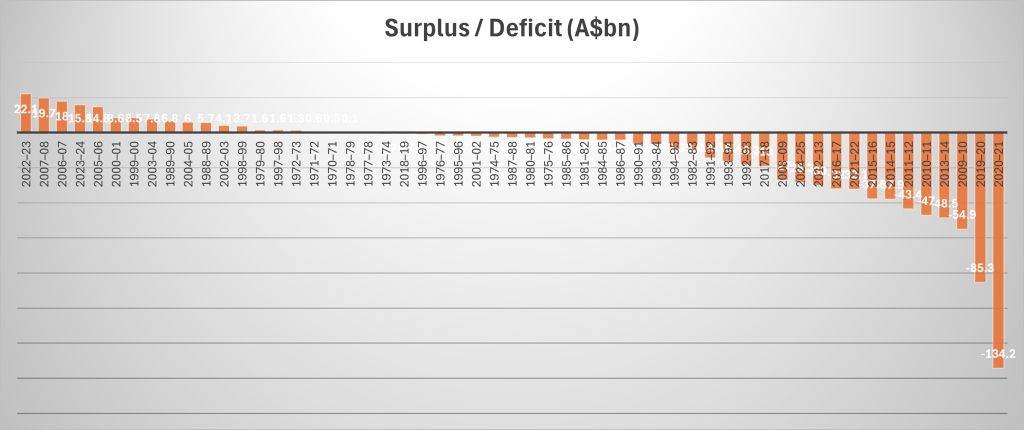

The good news is, despite the noise from the media and unthinking economists, Australia usually runs a Commonwealth deficit. This is despite politicians of all stripes arguing that a Government surplus is something to be pursued. When push comes to shove, few politicians are actually game to make the economy smaller. You can see this in the graph below, which sets out the relevant surplus or deficit for the last fifty years, ranging from surpluses on the left to deficits on the right.

(Source: Australian Treasury, Historical Australian Government Budget Outcomes (Underlying Cash Balance) Note the graph is not in chronological order).

As you can see, we run deficits 70% of the time. The pity is, very few Australians know this is a good thing, and our collective attitude to ‘deficits’ makes the economy smaller than it needs to be.